CREATED on SATURDAY, July 21, 2018

The True Gold Standard–A Monetary Reform Plan Without Official Reserve Currencies (Second Edition–Newly Revised and Enlarged), Lewis E. Lehrman, 2012. Posted Saturday, April 20, 2024

Thanks to Tom Luongo for this letter from Judy Shelton, saying that gold ownership could be abolished in 2026. Posted Saturday, April 20, 2024

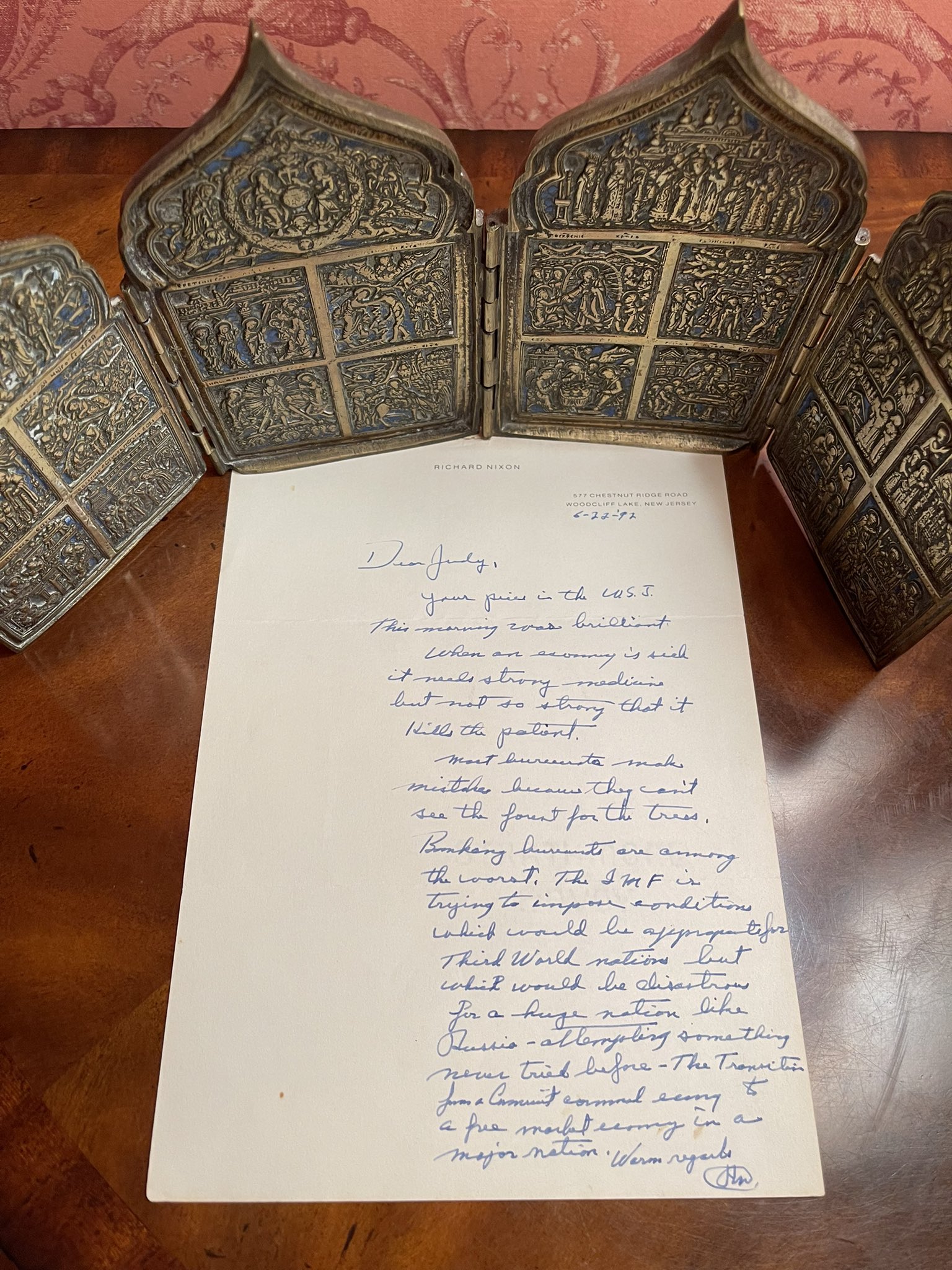

This is not an exact transcription, but here is my best:

This article on gold, authored by Kelsey Williams, provides the best explanation on gold I’ve ever read. [Find more articles by him here.] Gold’s price is not based on recessions, business failures, or based on inflationary times. Gold’s price is tied to the strength of the dollar. If the dollar is weak, gold is strong. If the dollar is strong, gold’s price tends to tank.

Gold’s price is not an indication of its value. The value of gold is constant and does not change. Its price is a reflection of the value of the U.S. dollar. Nothing more. Nothing less. Nothing else.

And what is happening to the US dollar? It is in a state of constant deterioration, punctuated with periods of relative stability.

And the peaks and low points for those periods are seen clearly on both charts (1933, 1971, 1980, 2001, 2011) and correspond with highs and lows for the price of gold, both in nominal and real terms.

Gold is not an investment. When gold is characterized as an investment, the incorrect assumption leads to unexpected results regardless of the logic. If the basic premise is incorrect, even the best, most technically perfect logic will not lead to results that are consistent.

INFLATION

Use this inflation calculator.

U.S. DOLLAR INDEX is here and here at MarketWatch.

Use the U.S. Dollar Index as an indication of the strength of the U.S. Dollar. This was a decent illustration of how the U.S. Dollar trades against other currencies.

Wikipedia entry on the U.S. Dollar was very helpful.

The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies,[1] often referred to as a basket of U.S. trade partners’ currencies.[2] The Index goes up when the U.S. dollar gains “strength” (value) when compared to other currencies.[3]

The index is maintained and published by ICE (Intercontinental Exchange, Inc.), with the name “U.S. Dollar Index” a registered trademark.[4][5]

It is a weighted geometric mean of the dollar’s value relative to following select currencies:

1. Euro (EUR), 57.6% weight

2. Japanese yen (JPY) 13.6% weight

3. Pound sterling (GBP), 11.9% weight

4. Canadian dollar (CAD), 9.1% weight

5. Swedish krona (SEK), 4.2% weight

6. Swiss franc (CHF) 3.6% weight

This was also interesting and useful.

USDX started in March 1973, soon after the dismantling of the Bretton Woods system. At its start, the value of the U.S. Dollar Index was 100.000. It has since traded as high as 164.7200 in February 1985, and as low as 70.698 on March 16, 2008.

AUGUST 16, 2018: GOLD & THE PRICE OF OIL

Gary North on gold and how it is tied to the price of oil, August 16, 2018.

Jim Rogers thinks gold will go below $1000. I do, too. But I think people need some bullion gold coins in their possession, even if they pay $1200.

Rogers says he will be a buyer below $1000. He also holds gold.

Gold coins can be transferred to heirs easily. If gifts, the recipients do not pay a tax until they sell. Then the price at which a parent bought the coins becomes the base. The capital gains tax applies.

In death settlements, the coins pass at market value and no tax is owed in most cases. See your CPA. Gold coins are a great way to pass wealth to heirs.

So, if you own no coins, buy some. But their price will probably fall in the early phase of the recession. They will boom when the FED inflates, which it will.

Gold is a commodity. Commodity prices fall in a recession. But gold, unlike other commodities, is a crisis hedge. Its price will rebound before the recession is over.

Tom Woods interviews Mark Skousen on January 22, 2016, where Skousen criticizes the gold bug Austrians and says that there is always opportunity in stocks or equity markets.